-

-

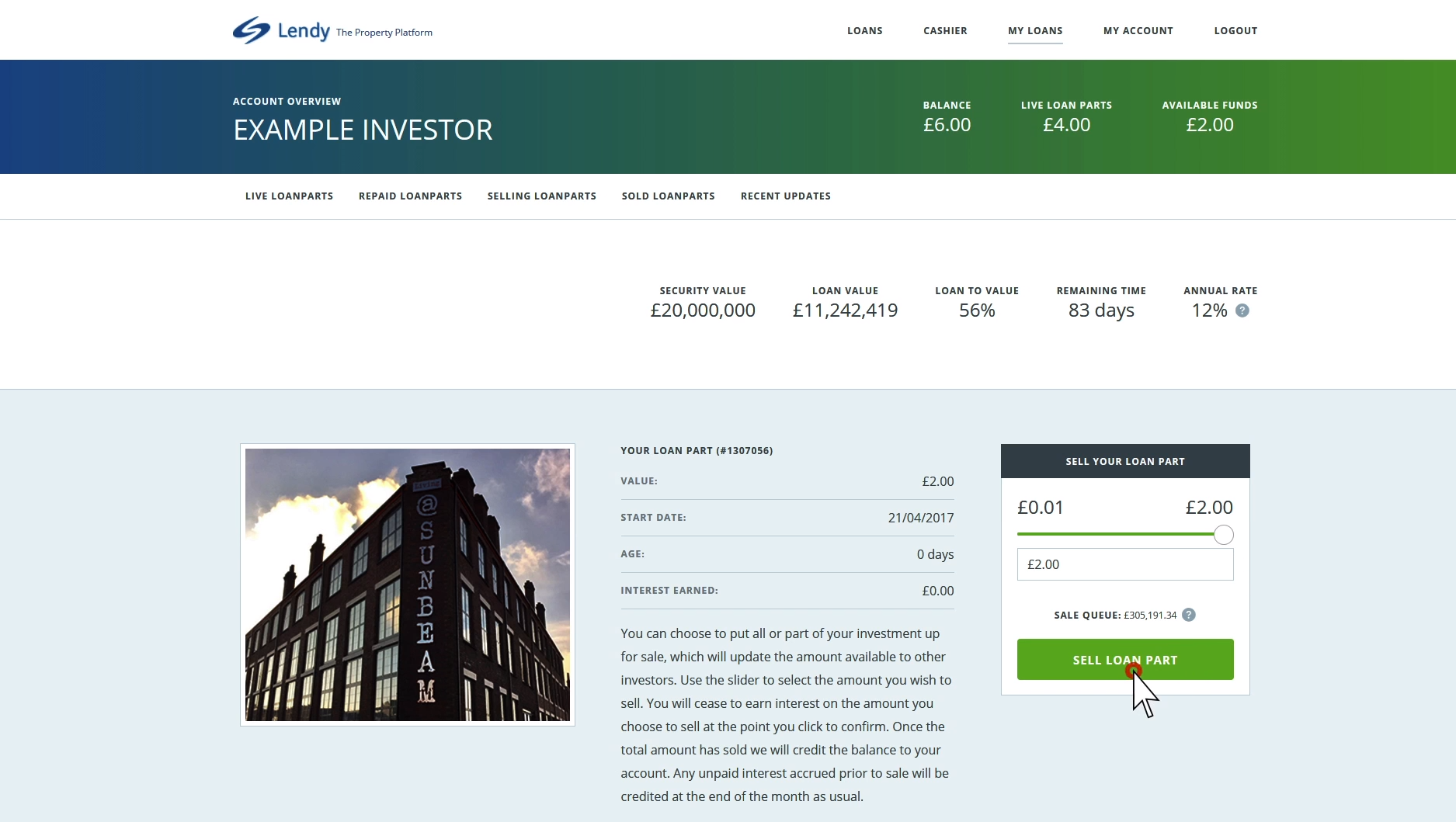

The withdrawal facility is now available to all investors with an AML/KYC verified account

Joining Lendy just got more rewarding!

Join Lendy today to receive your new investor bonus and chance to win a VIP day at Lendy Cowes Week.

See New Investors below for more information on the benefits of becoming an investor.

New investors

Claiming your new investor bonus is easy

-

1. Register

Click Register to invest to sign up for an account online.

-

2. Invest today

Invest at least £1,000 on the Lendy platform for minimum three months.

-

3. Receive bonus

We'll credit your Lendy account with £50 after your first investment of £1,000 or more has been invested for minimum three months on the platform.

Terms apply. See below for further details.

Terms & Conditions

- New lender offer open to individuals who have not previously signed up to Lendy

- To qualify as a lender you must successfully lend £1,000 or more through Lendy for a minimum of three months

- The decision to offer a new investor bonus will rest solely with Lendy. All management decisions are final

- Your capital is at risk and peer-to-peer lending is not covered by the Financial Services Compensation Scheme. Please refer to our disclaimer

Why invest with Lendy?

Our investors talk about their experience of investing with us

"You know exactly where you stand all of the time, you can just sit back, relax and watch every month for your money to accumulate which is the bit I like about it."

Gerry Haynes - Investor

"I love the ability to control exactly where my money's gone, invest in different projects and get great return on my money."

Benj Street - Investor

Three reasons to invest with Lendy

Fast and easy

It's a fast and easy signup process. You can fund your account immediately and start earning on your funds within minutes of your first click.

Simple to use

By monitoring the loans and updating the portfolio we take all the hard work out of your investment. All you have to do is choose your investment, fund your account and begin earning a good return.

Helps the economy

With peer-to-peer loans you are supporting the release of funds for projects that benefit the UK economy

Provision Fund

The Provision Fund is made up of contributions from the loans in our portfolio. The Provision fund is in place to assist in compensating investors in the event that the sale of the security property does not result in full repayment of the loan.